This article explains the IRS $2,000 January 2026 deposit in clear, practical steps. You will learn who qualifies, when deposits are made, how to claim the payment, and actions to take if the deposit does not arrive.

What is the IRS $2,000 January 2026 Deposit?

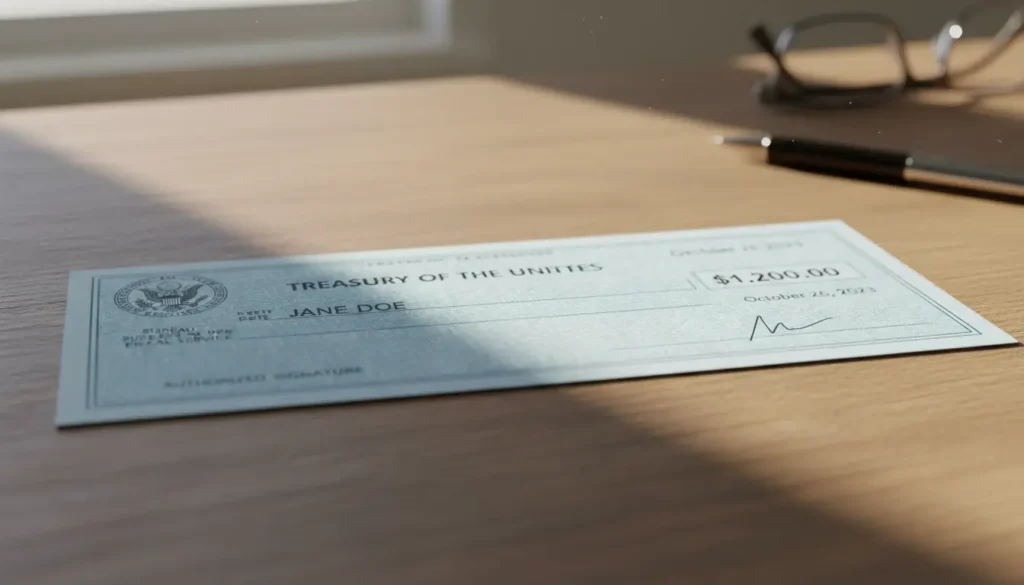

The IRS $2,000 January 2026 deposit is a planned payment for eligible taxpayers, intended as a one-time federal credit or advance. It may be part of a tax credit program or an advance on credit for the 2026 tax year. The deposit is issued directly by the IRS to qualifying bank accounts or by paper check.

Who is eligible for the IRS $2,000 January 2026 Deposit?

Eligibility depends on income, filing status, and existing rules tied to the specific credit. General qualifying rules often include U.S. residency and meeting income thresholds. The IRS may exclude nonresident aliens, certain dependents, or those with very high incomes.

Common eligibility criteria

- Filed a recent federal tax return for the qualifying year

- Meet income limits based on filing status (single, married filing jointly, head of household)

- Not claimed as a dependent on another taxpayer’s return

- Provided direct deposit information to the IRS or Social Security Administration

How the schedule works for the IRS $2,000 January 2026 Deposit

Deposits usually follow a phased schedule. The IRS often issues payments in waves starting with direct deposits, followed by paper checks and debit cards. Exact dates depend on IRS processing timelines.

Typical deposit timeline

- Early January 2026: First direct deposits to taxpayers with up-to-date bank information

- Mid to late January 2026: Additional direct deposits and electronic transfers

- Late January to February 2026: Paper checks and mailed debit cards arrive

How to check if you will receive the deposit

Confirm your eligibility and payment status using official IRS tools. The IRS usually updates an online portal where you can check payment status and method. Keep your tax account and mailing address current to avoid delays.

Steps to verify payment status

- Log in to your IRS account or the official payment status portal.

- Enter required verification details such as Social Security number and date of birth.

- Review the payment method listed: direct deposit, paper check, or debit card.

How to claim the IRS $2,000 January 2026 Deposit

If the payment is an advance on a tax credit, you may need to claim it on your 2026 tax return. If you did not receive the payment but were eligible, you may file a claim when you file your 2026 return.

Claim steps at tax filing

- Complete your 2026 federal tax return and include the credit line for the $2,000 payment.

- Report the amount you actually received, if any, as instructed on the form.

- If you did not receive the payment but are eligible, enter the full credit amount to claim it at filing.

What to do if you do not receive the deposit

If you expected the IRS $2,000 January 2026 deposit but did not receive it, follow these immediate steps. Delays often result from outdated bank info, unmet eligibility, or mailing errors.

Action checklist

- Verify your bank account and mailing address with IRS records.

- Check the IRS online portal or notification channels for updates.

- Keep proof of eligibility, such as your 2024 or 2025 tax return.

- Claim the credit on your 2026 tax return if you still qualify.

The IRS may adjust payment amounts or eligibility after the final rules are published. Always check the IRS site for official guidance before relying on the deposit.

Common questions about the IRS $2,000 January 2026 Deposit

Is the deposit taxable?

Most federal credits or advance payments are not taxable income, but they may affect eligibility for other benefits. Confirm the taxability on the official IRS instructions for the specific credit.

Will dependents receive their own deposit?

Payments tied to dependent status vary. Some programs credit the parent or guardian rather than issuing separate checks to dependents. Check eligibility tables in IRS guidance.

Small case study: Real-world example

Maria, a single parent, filed her 2025 taxes electronically and had direct deposit on file. She met the published income limits and appeared on the IRS payment portal as eligible. Her direct deposit arrived on January 10, 2026, and she used the money to cover childcare and bills. When she filed her 2026 return, she reported the advance correctly and had no complications.

This example shows how keeping tax records current and using direct deposit speeds receipt of funds.

Final tips for handling your IRS $2,000 January 2026 Deposit

- Keep your IRS account details and mailing address up to date.

- Use direct deposit to receive funds faster and more securely.

- Save any IRS notices and your tax return paperwork for 2026 filing.

- Contact a tax professional if your situation is complex or if you need help claiming the credit.

For authoritative details, always consult the IRS website and official notices related to the IRS $2,000 January 2026 deposit. Policies and dates can change, and the IRS will publish final instructions that control how to claim or report the payment.